changing the face of funding

the leap.club table is here, take a seat.

venture funding in 2021 broke records across the board, and it rained ipos and unicorns.

as per crunchbase - “global venture investment last year totaled $643 billion, compared to $335 billion for 2020—marking 92% growth year over year. the figures underscore a dramatic change in the startup funding environment in the past year.”

despite this dramatic change, there is one stat that did not move at all.

in india, unfortunately, the stats are even worse. at leap.club, we have ~800 founders as members, who voice these challenges during fireside sessions, intimate huddles and in the community discussions that we have everyday.

4 weeks ago the leap.club team was discussing ‘women’s day’ internally. no prizes for guessing that brands love us around this time of the year so we were swamped with emails/ collaboration requests/ all the love in the world. but for a mission + outcome oriented team like ours, we are always hungry for some real action → real impact.

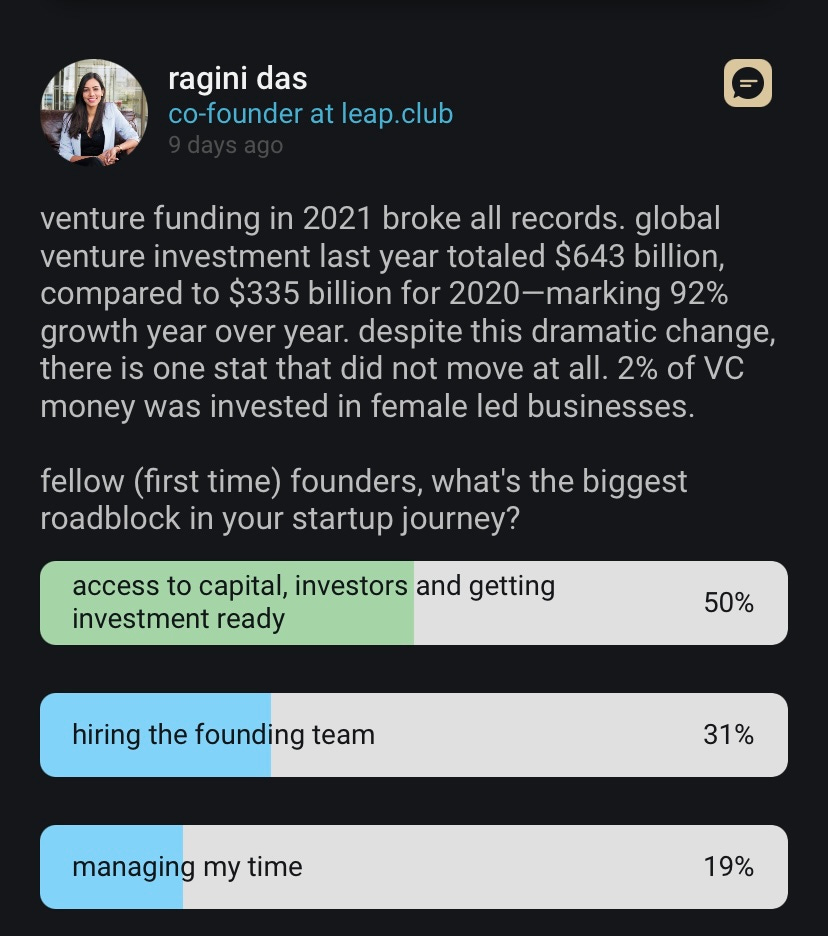

so we spoke to fellow founders about their roadblocks :

on #2 and #3, our members help each other a lot. experienced founders always give back to the newer ones, and vice versa. we also have 3 start up focused micro-communities with 1000+ members who are founders or budding ones.

for #1, we realised that we, as leap, can do more to help. we’re thrilled to announce the launch of:

the leap.club table will invest in companies (raising their first external funding round) led by female founders via angellist. here’s how it will work -

leap.club will launch a syndicate and lead investments as the primary investor.

top angels have joined us to back the founders.

whiteboard capital, titan capital, enzia ventures have joined us as venture partners and will fast-track evaluation of the shortlisted companies for independent investments.

we will continue to leverage our extensive network and add prominent founders, angels and investors to back the founders. we will also invite our 4,500+ (and rapidly growing) member base to invest.

we will open this up for all female founded companies raising their first round of funding.

the leap.club team will work with the founders (and help in any way they can to prepare them for the raise), shortlist and do all the backend work needed to get them ready for investment.

to encourage leap.club members and other angels, the carry charged by us will be only 5% (plus 5% charged by angel list, so total 10%) instead of the 20% which is the norm. we charge this 5% so that we are able to build a strong team that leads this initiative for years to come. what’s carry? read here.

we hope to fund 10-12 companies in 2022.

if you are a female founder reading this, then please write to us at thetable@leap.club.

investor? back the syndicate here: https://angel.co/s/leapclub/lg3MK

here’s to building our own damn table.

– ragini, anand and all your friends at leap.club